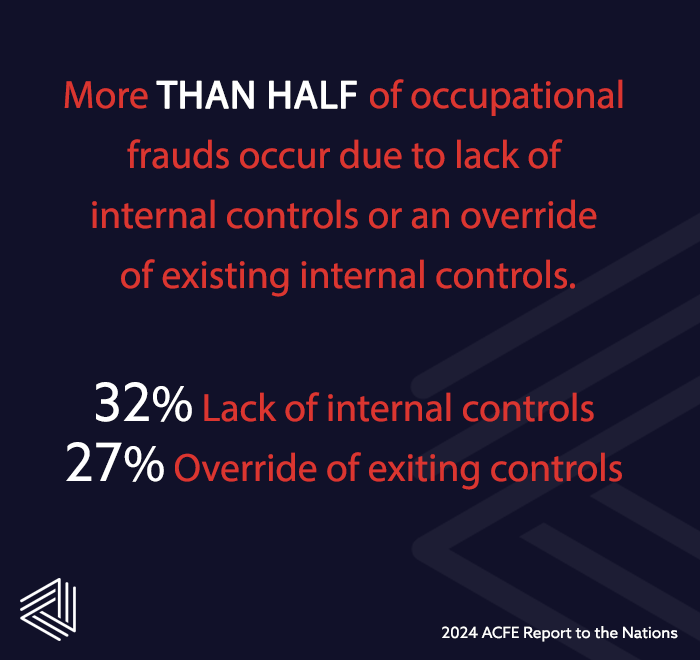

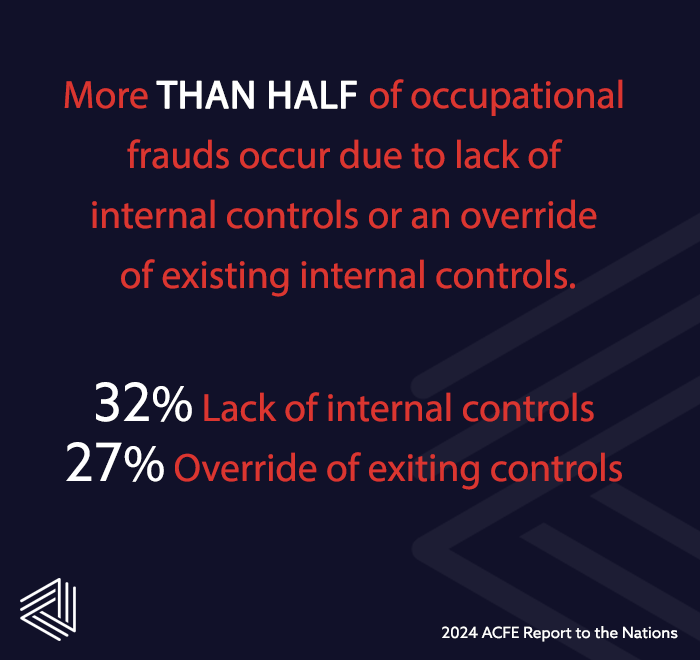

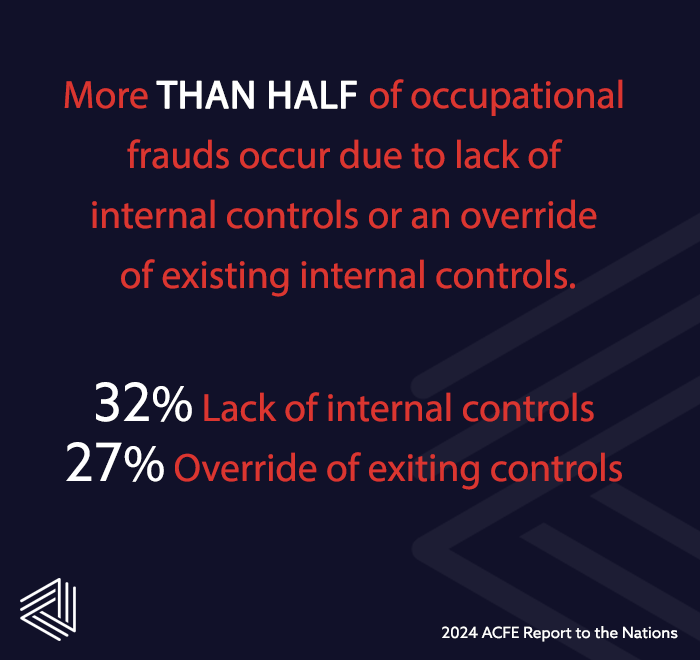

Internal Controls

In today’s complex business environment, effective internal controls are crucial for maintaining operational integrity, ensuring accurate financial reporting, and safeguarding against fraud. At TriRisk, we leverage our expertise to help you build a robust internal control framework aligned with the COSO Internal Control – Integrated Framework.

Comprehensive Internal Control Services

To help you meet regulatory requirements such as Sarbanes-Oxley Act Section 404 (SOX 404), TriRisk provides:

• Business Risk and Fraud Analysis: In-depth assessments to identify potential fraud risks.

• SOX Compliance and Internal Audit Review: Ensuring SOX compliance through independent reviews and optimization of internal audit processes.

• Internal Control Documentation and Formalization: Documenting controls, formalizing responsibilities, and establishing strong internal control structures.

• Segregation of Duties and Authorization Procedures: Recommendations for effective duty segregation and clear authorization procedures.

• Physical and Accounting Controls: Implementing safeguards for assets and accounting system controls.

Our Approach

Our internal control strategy focuses on two key components:

1. Policies: Clearly defined guidelines that outline the proper ways to conduct business activities.

2. Procedures: Detailed steps for effectively implementing and monitoring these policies.

We utilize cutting-edge technology to automate and streamline internal control processes, enhancing efficiency and reducing human error.

Benefits of Strong Internal Controls

By partnering with TriRisk, you can expect:

• Improved financial accuracy and reliability

• Enhanced operational efficiency

• Stronger regulatory compliance

• Reduced risk of fraud and errors

• Increased stakeholder confidence

Want to learn more?

Take the first step towards strengthening your organization's governance. Contact TriRisk today for a comprehensive internal control assessment and tailored solutions to meet your unique needs.